On Monday, as MPR’s Martin Moylan reported, U.S. Bank paid $200 million to make a federal probe into its shoddy mortgage lending practices go away. The firm ignored lending rules from 2006 through 2011.

People lost their homes. Taxpayers lost millions covering the loans. The bank lost some petty cash in the settlement.

“By misusing government programs designed to maintain and expand homeownership, U.S. Bank not only wasted taxpayer funds, but inflicted harm on homeowners and the housing market that lasts to this day,” Stuart F. Delery, the assistant attorney general for the Justice Department’s Civil Division said.

“U.S. Bank’s lax mortgage underwriting practices contributed to home foreclosures across the country,” United States Attorney for the Eastern District of Michigan Barbara L. McQuade said in a press release. “This settlement recovers funds for taxpayers and demonstrates that lenders will be held accountable for engaging in irresponsible lending practices.”

But the bank admitted no wrongdoing. And that’s the problem.

Despite pressure to remove the provisions admitting no wrongdoing, financial institutions continue to skate on the most basic of facts. Can you be held accountable if you don’t admit what you did was wrong?

Today, another settlement on a despicable situation also let the perpetrator off the hook.

New York Attorney General Eric Schneiderman announced the settlement Quadriga Art and Convergence Direct Marketing, two fundraising organizations that are behind many of the appeals you receive to help disabled veterans. But they didn’t help disabled veterans. They got rich by using them. The fundraising firms made $100 million on solicitations from people who thought they were helping the vets, according to Schneiderman.

According to CBS News:

The tactics Quadriga and Convergence used to raise that money were shady. The direct mail campaigns that solicited money from consumers used a moving — but fake — story about a veteran who had purportedly been wounded and helped by the charity. The firms also made claims about services DVNF provided around the country that didn’t exist.

“This investigation sheds light on some of the most troublesome features of direct-mail charitable fundraising as it is practiced in the United States today,” Attorney General Eric Schneiderman said in a statement. “Taking advantage of a popular cause and what was an unsophisticated startup charity, these direct mail companies used cleverly designed but misleading mailers to raise tens of millions of dollars in donations from generous Americans, nearly all of which went to the fundraisers and their agents, and left the charity nearly $14 million in debt.”

It was a scam, basically.

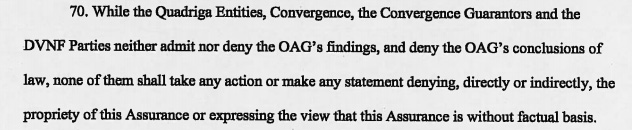

The settlement includes 74 provisions, including #70:

Under the settlement, some of the money — a fraction of it — will go to disabled veterans organizations.

It’s not as if some judges aren’t trying to end the wrist slaps. U.S. District Judge Jed Rakoff rejected a $285 million settlement the Securities and Exchange Commission reached with Citigroup in 2011 on allegations of mortgage fraud.

“A consent judgment that does not involve any admissions and that results in only very modest penalties is just as frequently viewed, particularly in the business community, as a cost of doing business imposed by having to maintain a working relationship with a regulatory agency, rather than as any indication of where the real truth lies,” Judge Rakoff wrote.

Last month, Rakoff got his comeuppance when a U.S. appeals court panel ruled he’d overstepped his authority in demanding an admission of wrongdoing.